The Discount Rate That Equates the Present Value

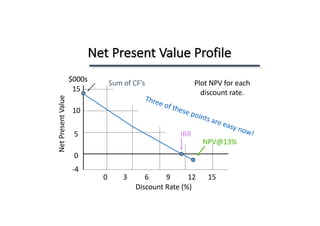

In capital budgeting parlance it is that discount rate that makes the net present value NPV equal to zero. See the answer See the answer See the answer done loading.

Net Present Value Irr And Profitability Index

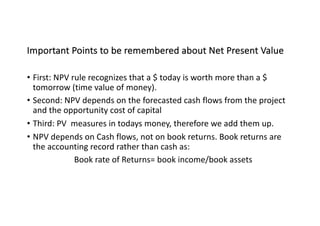

The term discount rate is used when looking at an amount of money to be received in the future and calculating its present value.

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

. Internal rate of return. 22An advantage of the net present value method over the internal rate of return model in discounted cash fow analysis is that the net present value method a. That it measures the benefits relative to the amount invested 11.

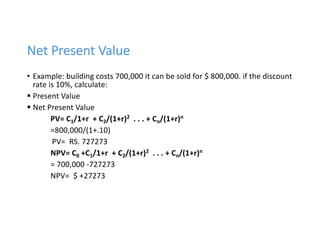

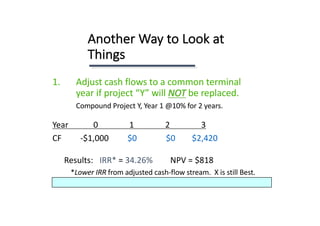

Initial outlay for Project 1 is 1495 with expected after-tax cash flows of 500 per year in years 1-5. Modified Internal Rate of Return MIRR The discount rate at which the present value of a projects cash outflows is equal to the present value of the sum of its future cash inflows assuming that cash flows are reinvested at the. The net cash flows of the project and their present values are as followsYear 1 2 3 4 Net cash flow Rs 5100 5100 5100 7100 PVIF 12 0893 0797 0712 0636 Present Value Rs 4554 4065 3631 4516 The initial investment in the project is Rs12500 What is the NPV of the project.

The firms net profits after. This value is calculated by summing a projects expected annual cash inflows until their cumulative value equals the projects initial cost. The process of analyzing projects and deciding which are acceptable investments and which actually should be purchased.

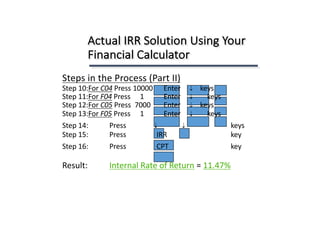

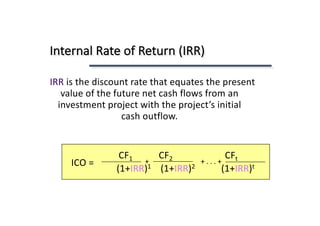

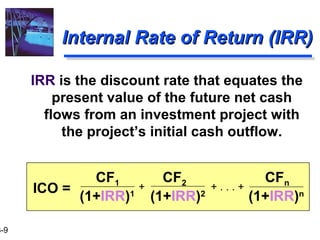

Internal Rate of Return IRR the rate of return that the project earns. New questions in Social Sciences. -for the computational purposes the internal rate of return is defined as the discount rate that equates the present value of the projects free cash flows with the projects initial cash outlay.

Net present value c. Net Present Value Profile. Alla 95 11 months ago.

The _____ is the discount rate that equates the present value of the cash inflows with the initial investment. The discount rate that equates the present value of the debt 5795518 and its from ACCOUNTING 111122 at Oxford University. On a purely theoretical basis the NPV is the better approach to capital budgeting due to the following reason.

The IRR of a project is the discount rate that equates the present value of future cash flows to the initial investment. But please add in a brain list. Internal rate of return c.

The _____ is the discount rate that equates the present value of the cash inflows with the initial investment. After-tax cash flows for Project 2 are expected to be 2000 per year for years 1. A firm has the following accounts and financial data for 2014.

A payback period B average rate of return C cost of capital D internal rate of return. This problem has been solved. The internal rate of return is that discount rate which equates the present value of the cash outflows or costs with the present value of the cash inflows.

Cost of capital d. Average rate of return c. The discount rate that equates the present value of a capital projects expected cash inflows and its initial cost.

Cost of capital Selected. The rate of return that makes the NPV positive. Is the discount rate that equates the present value of the cash inflows with the initial investment 10.

D internal rate of return. A discount rate is deducted from a future value of money to provide its present value. The discount rate that equates the present value of the cash inflows with the present value of the cash outflows.

Internal rate of return d. The below scenario clearly explains the terms discount rate present value and net present value. Computes a desired rate of return for capital projects.

The discount rate that equates the present value of the expected cash flows with the cost of the investment is the. A project has an initial investment of 1million and a profitability index of 110. The _____ is the discount rate that equates the present value of the cash inflows with the initial investment.

If the Money Discount Rate is 19 and Inflation Rate is 12 then the Real DiscountRate is. The discount rate that makes NPV negative and the PI greater than one. Internal rate of return This answer is correct.

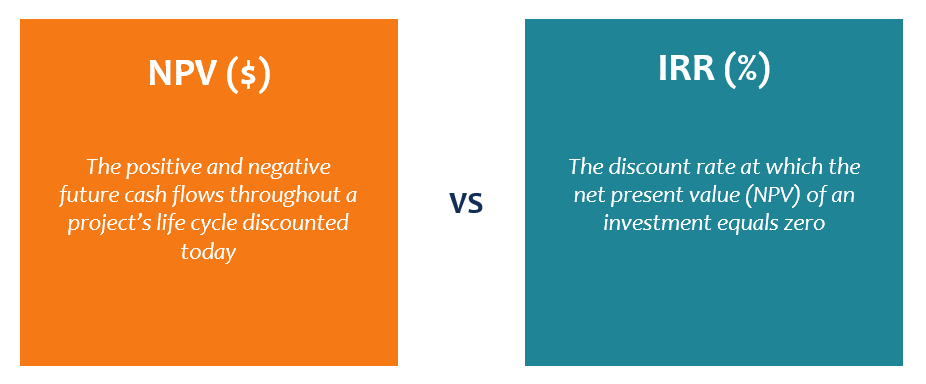

The IRR of a project is the discount rate that equates the present value of future cash flows to the initial investment. The word discount means to deduct an amount. Comparing net present value and internal rate of return _____.

Payback period Incorrect b. 1 1 Question 5 A firm is evaluating a proposal which has an initial investment of 50000 and has. The discount rate which equates the present value of terminal cash in-flows to the initial cash out-lay is known as.

Can be used when there is no constant rate of return required for each year of the project. The interest rate that equates the present value of the cash flow received from a debt instrument with its market price today is the A simple interest rate. Question 4 The______ is the discount rate that equates the present value of the cash inflows with the initial investment.

Uses a discount rate that equates. In capital budgeting parlance it is that discount rate that makes the net present value NPV equal to zero. Accounting rate of return b.

Project 2 involves a capital intensive process requiring an initial outlay of 6704.

Capital Budgeting Decisions Should We Build This Plant Sovraj Gautam Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv Definition

Npv Vs Irr Overview Similarities And Differences Conflicts

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv Definition

Chapter 8 Lecture Net Present Value And Other Investment Criteria Ppt Video Online Download

Discount Rate An Overview Sciencedirect Topics

Net Present Value Irr And Profitability Index

Chapter 2 Introduction To Bonds Introductory Finance

Chapter 2 Introduction To Bonds Introductory Finance

Net Present Value Irr And Profitability Index

Net Present Value Irr And Profitability Index

Chapter 2 Introduction To Bonds Introductory Finance

Internal Rate Of Return Method An Overview Sciencedirect Topics

Net Present Value Irr And Profitability Index

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Comments

Post a Comment